SEATTLE — This week, a King County judge shot down a proposed merger between Kroger and Albertsons – two of the largest grocery retailers in Washington state – and now, court documents are showing just how much of a financial blow the deal could have delivered to Washingtonians’ wallets.

Kroger sought to acquire all of Albertsons’ business in a $25 billion deal announced in 2022. The move was met with swift outcry from customers, employees, and federal regulators worried about a near-grocery monopoly. Washington Attorney General Bob Ferguson launched a lawsuit to stop the merger, saying it would eliminate vital competition in the grocery market.

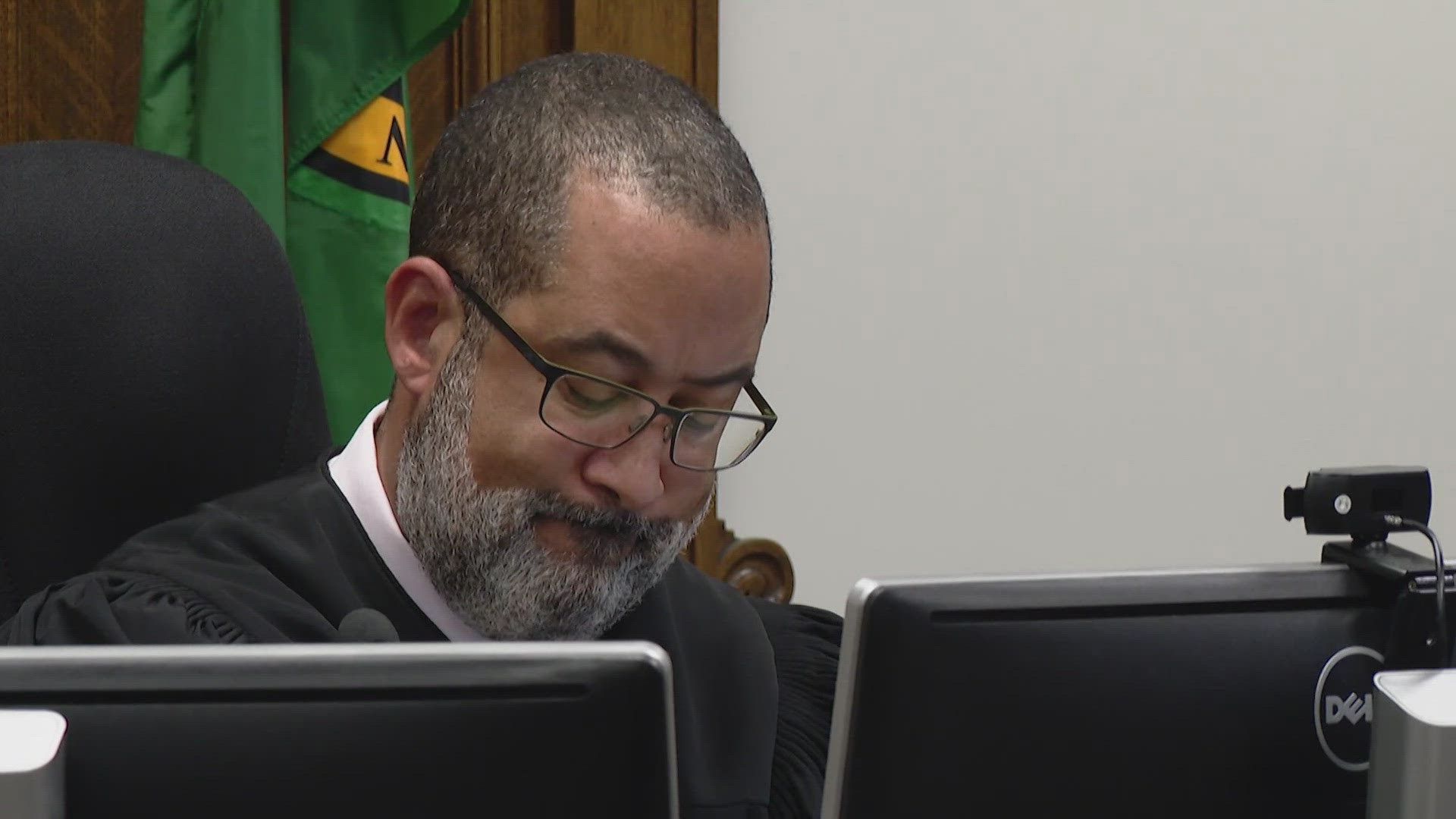

Judge Marshall Ferguson delivered his ruling Tuesday that the merger itself was anti-competitive, and would have increased, not lowered, grocery prices in Washington state, despite the insistence of the two grocery giants.

On the contrary, a state expert estimated grocery prices would likely have risen by 5% in Albertsons stores and 8% in Kroger ones if the deal was allowed.

“Overall harm to Washington consumers would be around $800 million each year in the form of higher grocery price increases,” the ruling stated.

Albertsons and Kroger own 320 stores in the state of Washington. Should the merger have gone through, the conglomerate would have had an average of 75% market share in 57 different city areas in Washington state. The Supreme Court has held in the past that a share of more than 30% presents an “unacceptable threat of anticompetitive effects.”

Kroger and Albertsons are considered head-to-head competitors in the grocery market, and Kroger documents identify Albertsons as its closest competitor in Washington. The two companies would index their grocery prices against each other’s brands.

Marshall found that Kroger’s attempts to avoid a grocery monopoly in Washington by offloading stores were insufficient and likely to fail.

Kroger and Albertsons planned to divest over 400 stores nationwide to a company called C&S Wholesale Grocers. However, Marshall was not convinced that C&S would be able to pose the same competition to Kroger as Albertsons had done.

According to court documents, Kroger picked C&S’s divestiture offer over what were arguably stronger companies that were offering more money for the stores. C&S is inexperienced in running retail grocery operations and has a history of buying retail grocery stores, and then selling them off to their wholesale companies.

The retail stores the company does run are largely operating at a loss from when C&S bought them – and the company indicated in the past that they were not looking to expand in that arena. In a March 2021 quarterly report, C&S wrote: “We do not intend to grow our grocery retailing operations, or to operate the retail grocery stores long-term.”

C&S indicated publicly they planned to run the retail stores they would acquire in the Kroger-Albertsons merger, but internal documents showed executives were fielding questions from their wholesale customers about potentially selling them off.

The stores Kroger selected to sell off in Washington state also indicated that the deal was not likely to increase competition. Kroger opted to keep its top 25 performers while saddling C&S with some of the lowest ones, court documents state. It also made sure to keep a QFC in the University Village in Seattle, despite offloading other stores under that banner, due to the high value of the real estate.

Since the merger was shot down in several courtrooms – including Seattle, King County and on the federal level – Albertsons has since announced that they will no longer be pursuing the merger and have filed a lawsuit against Kroger for failing to make it happen.

“Kroger willfully breached the Merger Agreement in several key ways, including by repeatedly refusing to divest assets necessary for antitrust approval, ignoring regulators’ feedback, rejecting stronger divestiture buyers and failing to cooperate with Albertsons,” a spokesperson said in a statement.

An attorney representing Albertsons went on to say that Kroger’s “self-serving conduct” has harmed Albertsons’ shareholders, associates and consumers, adding “We are disappointed that the opportunity to realize significant benefits of the merger has been lost on account of Kroger’s willfully deficient approach to securing regulatory clearance.”