Governor Inslee and the legislature are considering millions of dollars in new taxes, at a time when many Washington residents are already feeling maxed out on taxes.

But are we really maxed out?

To examine how our state measures up when it comes to taxes, we looked at four key areas of taxation:

Income tax

Washington doesn't have an income tax.

Property tax

All states have property taxes. According to the Tax Foundation, Washington ranks No. 25 when it comes to property taxes.

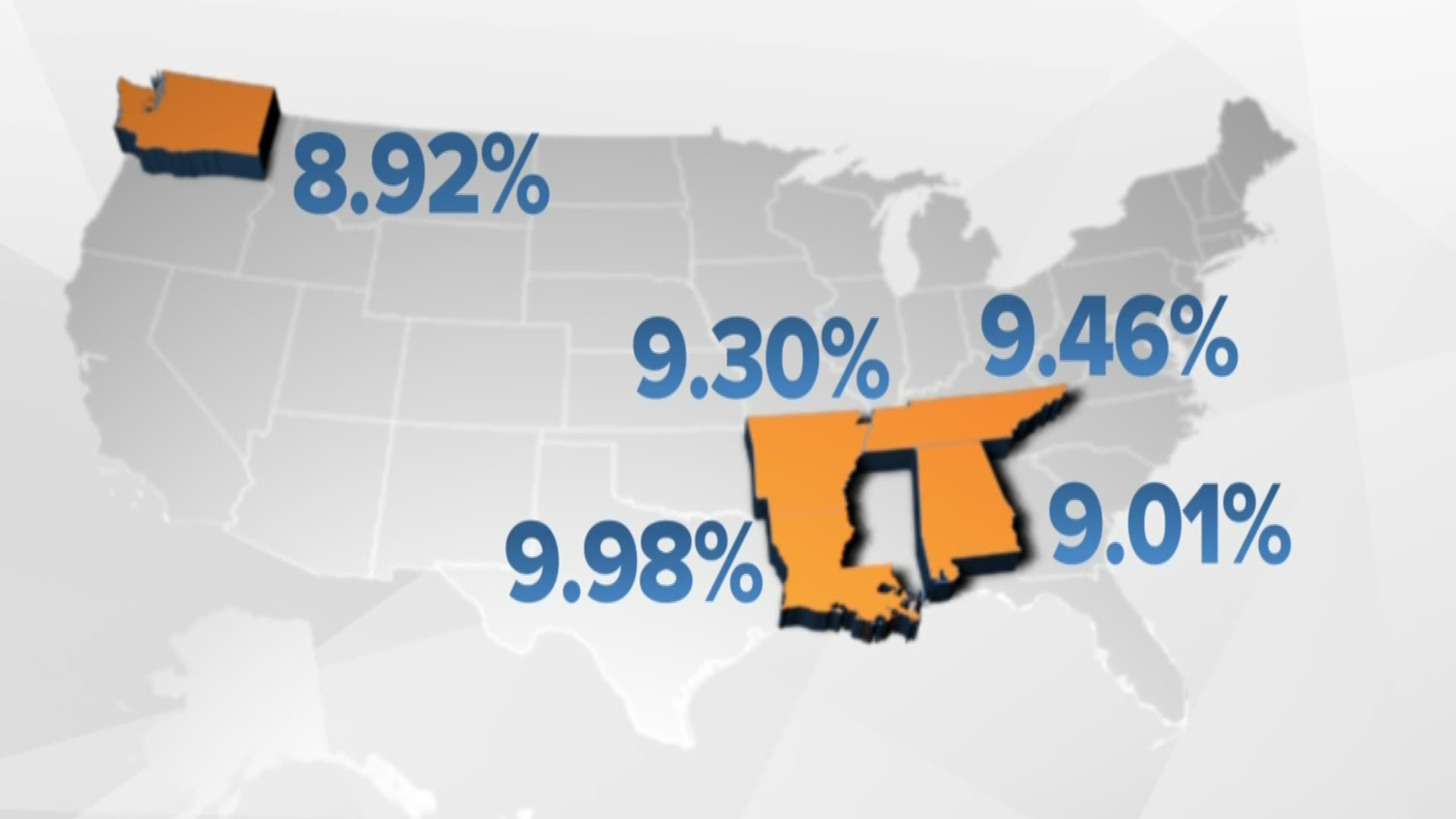

Sales tax

Washington has one of the highest sales taxes in the country -- next to Louisiana, Alabama, Arkansas and Tennessee.

It's common for states without income taxes to have higher taxes in other areas.

Bob Mahon, a Seattle Tax Attorney, says "relative to many states and countries, we are under taxed in Washington."

Business tax

The way Washington taxes businesses is also of note. Washington is one of only four states in the country that uses a gross receipts tax instead of an income tax.

What does that mean?

Let's say you have a lemonade stand and you made $50 for the day, but you spent $20 on supplies. Most states will tax you on your profits -- the $30 you actually took home.

Washington taxes you on your revenue regardless of expenses. So it would tax your $50, but at a lower rate.

Our business tax climate is called potentially harmful by tax experts.

Seattle tax attorney, Scott Edwards says, "the other aspect of affordable is not just the tax, but the cost of doing business, which in addition to taxes, regulations, permits makes it harder to build more housing, more office space, retail and that drives up rents as well."

Bottom line: Are we paying too much in taxes?

Well, it depends on the comparison.

And if it's Washington versus the rest of the country -- we are overall right in the middle.