SEATTLE, Wash. — In the next five minutes dozens of West Seattle high school juniors will get careers and monthly incomes.

Some will get married.

Some will have babies.

The goal? To not go broke.

"I'm not very good with money if I'm being completely honest,” confessed student Yair Diaz.

“I'd say I'm decent, I save some of my money but then yeah, I spend some of it too,” said Ella Richardson, another student.

Both are participating in a Financial Reality Fair, put together by BECU, a not-for-profit credit union. When Evening visited, employee volunteers are used their company-granted annual day of service to teach these kids that life is expensive.

“What we're doing is we're having them step into adulthood, and make purchases at every station,” said Stacey Black, a BECU financial educator who guides the kids through the hands-on money lesson. “And the idea is for them to go over budget, and it's in a safe environment."

With profession and monthly income assigned, the kids move from station to station in the gym, choosing options for housing, childcare, and transportation: will it be a new sports car with a payment? Or public transit?

At one station they must decide if that daily Starbucks fix is truly worth almost $100 a month.

Red vested BECU volunteers are on hand to help – and to upsell the students.

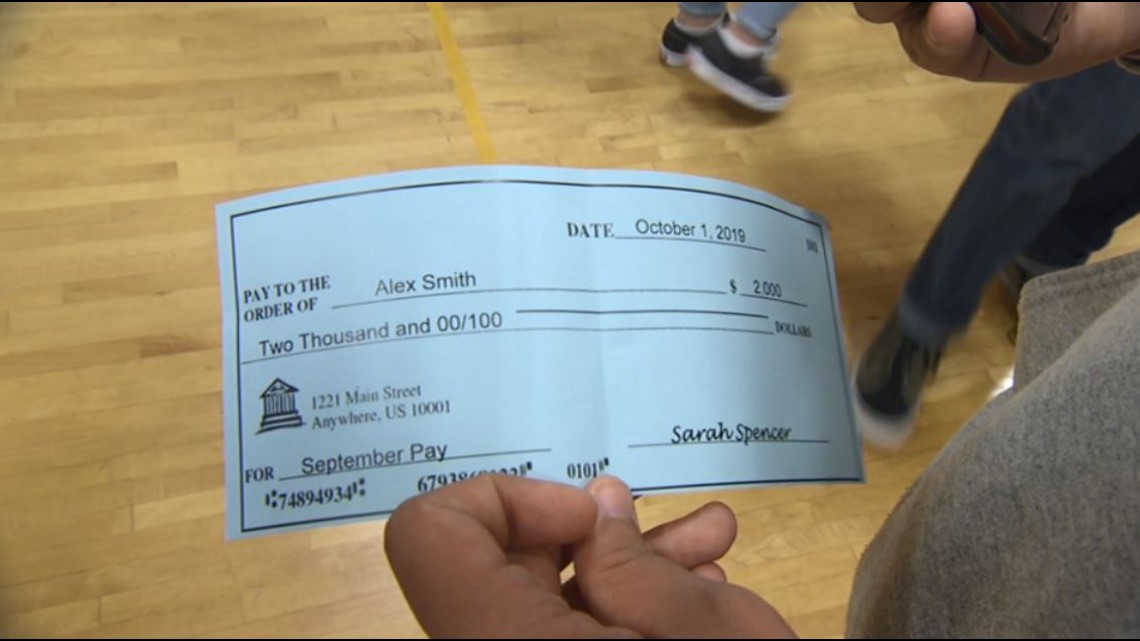

"So we talk to them (the volunteers) ahead of time and tell them to get the kids to buy the most expensive car, house, really pressure them, just like in real life they're going to get those pressures,” explained Black. This program which has been going on for 5 years added a new twist this year: Fraudsters who circulate among the kids giving them bad checks to deposit, and promising them 200 dollars in return. The kids later learn the free money wasn't free. Black says teens are the number one target for scams like these.

We did find some frugal kids while we were there: Hinari Denobo is a senior who wants to be a heart surgeon, her family came from Kenya and taught her how to save, and how to appreciate what she has.

“I went to Ethiopia last summer and saw how people are on the streets and they don't have food to eat,” explained Denobo, “and teenagers here, every lunch we're going out and I'm like ‘No, I'm okay, I can make a home lunch.’ “

But Yair and Ella have a more typical experience once the spending is over.

“Initially I went way over budget, so I went back to 'Entertainment' and I couldn't take that trip to Hawaii. So I just went camping,” said Yair.

"I got in debt two times, so I returned a couple of things and was able to not be in debt at the end," said Ella.

BECU’S Black says this is normal: "The trend I see is overspending. And that's what we want them to do is make those mistakes in a safe environment.”

At the end of the day, spending too much money in a high school gym is bargain for everyone.

“This taught me that you really need to prioritize before spending your money," Ella said. "Spend it on the things that matter most before buying a smartphone or a vacation."

Story Sponsored by BECU. To get tips on talking to your teen about money, read The Next Big Talk.

KING 5's Evening celebrates the Northwest. Contact us: Facebook, Twitter, Instagram, Email.