SEATTLE — There is a silver lining to one of the fastest housing slowdowns facing the Seattle area in nearly a decade.

As rising mortgage rates continue to price out buyers forcing people to slash home prices, some families are choosing to stay where they are and remodel their homes instead.

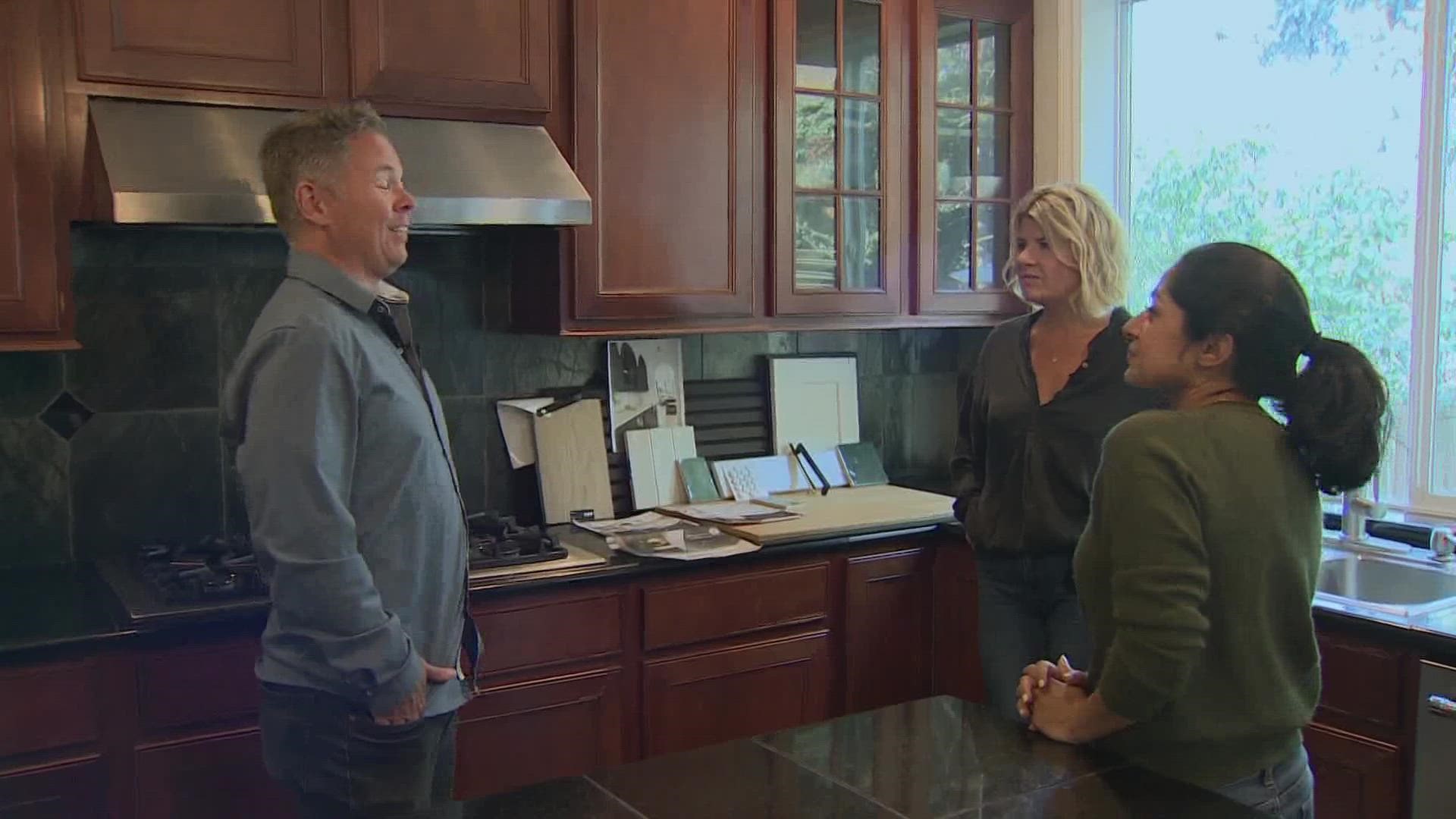

"They're choosing what I think is very wise, which is to invest in themselves, invest in the future, invest in the house," said Diana Roger, who has been flipping and remodeling homes for nearly a decade.

Roger said she has seen a 25% increase in client interest in remodeling homes over the last six months.

"I mean, even if we wanted to move, the rates being as bad as they are, it just is not affordable," said Jeff Lykken.

Jeff Lykken and his wife Helena are choosing to remodel their home to better fit the lifestyle they've grown into instead of moving.

"I would just love to be able to see the kids, you know, from the kitchen down to the entry," said Helena Lykken, who is most excited about changing the kitchen layout to accommodate more people.

Roger said the math makes sense for many families like the Lykkens. The couple bought their home in Renton for $469,000 in 2005.

While their HELOC, or Home Equity Line of Credit, took nearly six months to be approved, they were able to secure $150,000 at a 5% interest rate.

That's slightly lower than the around 7% rate on a 30-year mortgage, and that's not counting a down payment.

There's also the added value a remodel brings. The Lykkens hope the remodel increases their home's value by at least $150,000, or possibly $200,000.

A complete kitchen renovation has a 75% return on investment, according to the 2022 Remodeling Impact Report from the National Association of Realtors.

Roger said even with inflation, "certainly labor costs are up… gas prices are high, so shipping costs are high." She also said investing in a remodel could be a good bet while sellers wait for the market to stabilize.