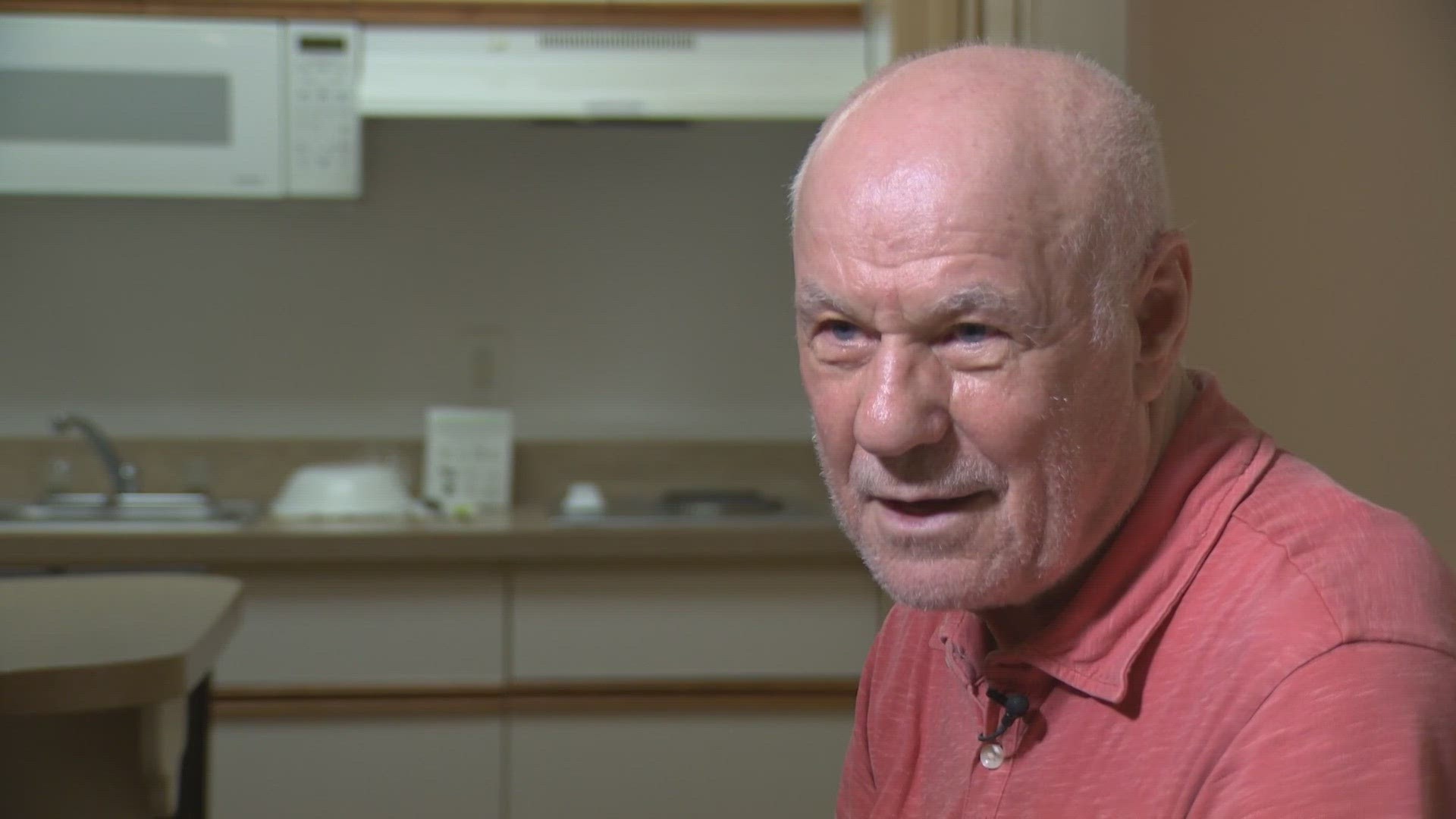

SNOQUALMIE, Wash. — Living at an Extended Stay America isn't where 76-year-old Bogdan Nalivaiko pictured he'd be after selling his Snoqualmie home for $960,000 in the spring, making $800,000.

"I was thinking I'll be buying in Auburn, maybe," the retiree said.

However, scammers would derail that plan. For weeks on end, Nalivaiko received text messages and phone calls promising he'd won millions of dollars but had to send money to receive those winnings. At one point, the scammers told him he'd won more than $17 million.

"I thought it was something like Publisher's Clearing House," Nalivaiko said.

Nalivaiko's money hit his Chase Bank on April 26. But by May 3rd, it was gone.

On the first day, he withdrew $200,000 in the form of four cashier's checks. Over the following days, he made several other withdrawals, mailed checks to addresses, bought Amazon gift cards and sent pictures of their numbers via text.

The scammers coached him through all interactions that could have held him up from sending money, instructing him to tell the bank staff different lies if they questioned the large withdrawals.

"They said tell them I owe someone money or I'm sending it to my daughter," he said.

After being drained of his money, Nalivaiko put the pieces together.

"It's difficult," Nalivaiko said. "Hard to believe how I believed."

The problems had just started. Julia Elders, Nalivaiko's daughter, received an alarming call from the people who bought her dad's home. He was refusing to leave. At this point, she doesn't know what happened.

Through a mover, Elders found out her father has nothing packed. To get out before the deadline, it was going to be $4,000 to take on the monumental task of packing up and moving an entire home. She asked her dad if he could pay the mover but he told her his credit card was maxed out. Elders didn't push too hard because it had to get done. She paid for it. Afterward, she asked to be reimbursed for the money but was met with silence.

"He wouldn't say anything over the phone. I told him I could help him figure out how to wire the money, we can transact with the bank but still, nothing, he was quiet," she said of the conversation with her dad. That's when he finally said to her, "You'll see."

"I was like, 'Do you have no money?' And he said, no." Elders asked how it happened and he said, "I won sweepstakes. I won $17.3 million and I wired everything I owned as taxes to pay for the sweepstakes."

The mover, who's helped Elders manage this situation, found several cashier's checks receipts, bank account routing numbers, and names of people who received $800,000 from her father. She's turned all that information over to authorities and says the FBI is now investigating.

A GoFundMe has been started to try and help make up the lost money, but Elders wants the bank to take some responsibility for what happened.

"The fact the banks did not flag this, see this pattern and just give away $800,000 in a week is insane to me," she said. "There needs to be checks and balances for this type of stuff.

In her father's case, she thinks the bank should have realized something was up when he came to withdraw $200,000 in one day and the rest of it over the next several days.

"If a person of a certain age group comes in, know your customer. It's something banks are supposed to work on. We have to protect this giant, massive wealth transfer that's happening for the Boomers into their families. It's not gonna happen if banks continue to let this happen without intervening," she said.

The Washington State Department of Financial Institutions tells KING 5, banks and credit unions, under state law, do have the power to stop transactions if they believe it's related to a scam. However, there are no blanket criteria, meaning that the decision is up to each individual institution on how they handle suspected fraud. Some tellers may not feel comfortable or safe telling someone what they can and can't do with the money in their account.

Everyone is encouraged to talk to loved ones, young and old, about the dangers of financial scams. Resources on this topic can be found here.