WASHINGTON — The Senate on Wednesday night passed an unprecedented $2.2 trillion relief package that will include checks going directly to most Americans. The bill now heads to the House for its approval. President Donald Trump has said he will sign the legislation when it hits his desk.

The bill comes in response to the coronavirus pandemic that has shut down businesses and crippled economies around the globe. It would give direct payments to most Americans, expand unemployment benefits and provide direct grants and loans to businesses and hospitals.

The Associated Press has been working through the text of the 883-page bill and Republican and Democratic leaders in Washington have been sharing information.

U.S. citizens receiving Social Security as well as retirees are eligible for the money, according to news outlets, including Fox and Fortune.

The massive measure is the third COVID-19 response bill produced by Congress and by far the largest.

Who gets stimulus checks?

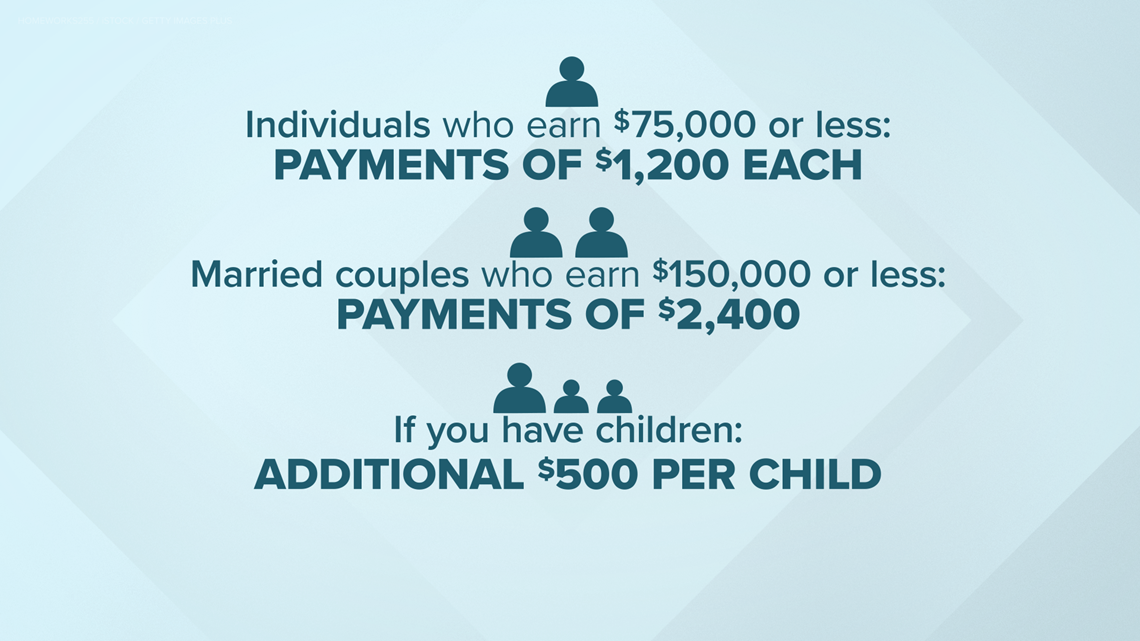

The bill would provide one-time direct payments to Americans of $1,200 per individual adults and $2,400 for married couples and an additional $500 for each eligible child.

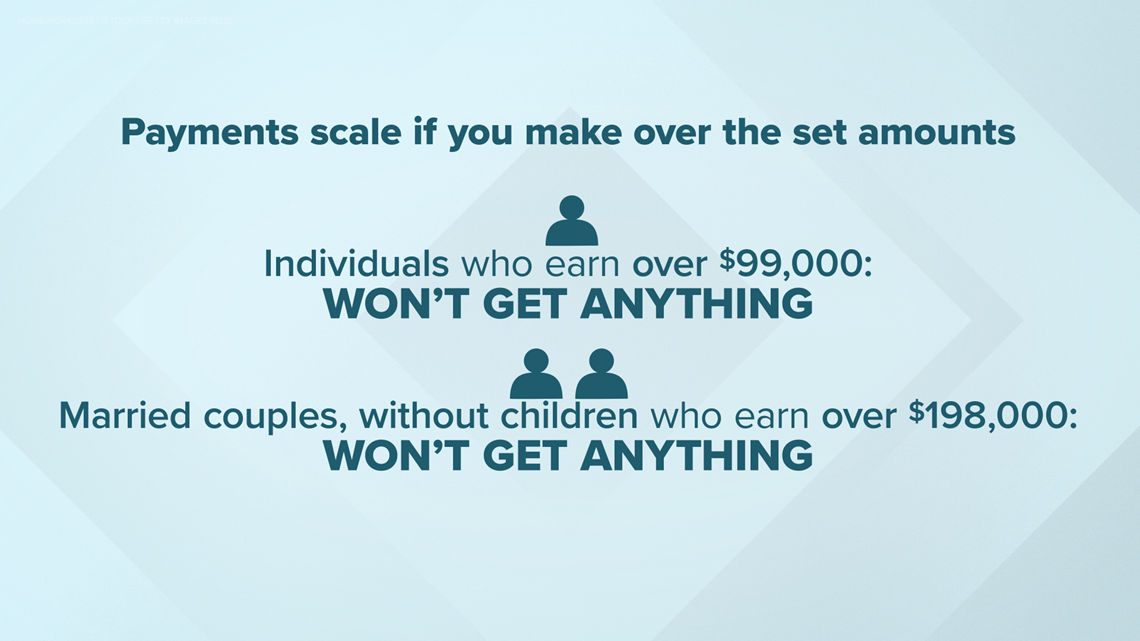

The full amount will be available for individuals making less than $75,000 and couples making less than $150,000 annually. The amount a person receives will phase out if they earn more, ending for those earning more than $99,000 annually.

When will stimulus checks go out?

Senate Minority Leader Chuck Schumer said Wednesday that Trump wants to send the payments to people in less than two weeks, by April 6. But experts agree that could be a hard deadline to hit.

During the White House coronavirus task force news conference Wednesday afternoon, Treasury Secretary Steven Mnuchin said the direct payments are expected to be out within "three weeks.” But history shows that's easier said than done.

Democratic aides in the Senate told The New York Times that those with direct-deposit info on-file with the IRS should see payments within a few weeks of the bill becoming law. However, if the IRS doesn't have that info, people may need to wait a lot longer to get a check. Aides told the Times it could be up to four months for a physical check to arrive.

The Tax Policy Center noted that in 2008 there was a gap of about three months between passage of the stimulus legislation and the start-up of payments. Additionally, the IRS had worked for three months before enactment of advance payments of tax rate reductions in 2001 and child tax credits in 2003.

What will furloughed workers get?

Furloughed or unemployed workers would get whatever amount a state usually provides for unemployment, plus a $600 per week add-on, with gig workers like Uber drivers covered for the first time. It includes an extra 13 weeks of coverage for people who have exhausted existing benefits.

Democrats said the package would help replace the salaries of furloughed workers for four months, rather than the three months first proposed.

Paycheck support

The bill provides $562 million to ensure that the Small Business Association has the resources to provide Economic Injury Disaster Loans (EIDL) to businesses that need financial support during this difficult time. These loans will help businesses keep their doors open and pay their employees. SBA has signed emergency declarations for all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, so the EIDL program will be available to assist small businesses across the country that have been adversely impacted by COVID-19.

This funding is in addition to the significant assistance provided in the Keeping American Workers Employed and Paid Act, which authorizes $350 billion worth of 100% guaranteed SBA loans, a portion of which SBA will forgive based on allowable expenses for the borrower.

This small business package also includes $10 billion in direct grants for businesses that do not qualify for the EIDL program and $17 billion to have SBA step in and make six months of principle and interest payments for all SBA backed business loans. All these measures combined will relieve financial stress from struggling businesses and inject much-needed capital into the economy.

Unemployment expansion

Establishes a new, much more generous unemployment benefit by adding $600 per week to normal state benefits for up to four months and provides an additional 13 weeks of benefits to 39 weeks of regular unemployment insurance through the end of 2020 if someone is sidelined by the outbreak. The coverage would be retroactive to Jan. 27. Extends coverage to “gig” workers and independent contractors.

Emergency funding, public health

The bill includes an additional $242 billion in additional emergency appropriations to fight the virus and shore up for safety net programs. That includes money for food stamps, child nutrition, hospitals, the Centers for Disease Control and Prevention, and public health and transportation agencies. The figure has gone significantly higher during talks over the weekend.

The measure includes $15.5 billion for food stamps; $14 billion for supporting farm income and crop prices; $9.5 billion for specific producers including specialty crops, dairy and livestock; $8.8 billion child nutrition. Money for food banks, farmers' markets.

Industry aid

The initial GOP plan called for $208 billion in loans to larger businesses like airlines, which would have to be repaid, and a subsequent; a version released over the weekend called for $500 billion. Leaders are still negotiating the final number and how the money would be provided by the administration and safeguards to prevent abuses. Delays payroll tax payments by employers. They would be able to defer payment of their 2020 payroll taxes until 2021 and 2022.

State aid

Republicans and the administration have resisted demands by Democrats and governors for aid to the states, whose governors have requested $150 billion to shore up budgets strained by large new costs and plummeting tax revenues. Negotiations are likely to produce a compromise. The smallest states would get at least $1.5 billion.

Loans and guarantees to businesses, state and local governments: $500 billion. Includes up to $50 billion for passenger airlines, $8 billion for cargo carriers, $17 billion for “businesses critical to maintaining national security." Companies accepting loans may not repurchase outstanding stock; must maintain their employment levels as of March 13, 2020 “to the extent practicable"; and bar raises for two years to executives earning over $425,000 annually.

Small businesses

Includes $350 billion. For companies with 500 employees or fewer, loans that may be forgiven if company retains workers; $17 billion to help small businesses repay existing loans; $10 billion for grants up to $10,000 for small businesses to pay operating costs.

Airlines

Airlines could get a key part of their request — cash grants from taxpayers — under the massive spending bill. As of Wednesday afternoon, the deal included $25 billion in direct grants and up to another $25 billion in loans or loan guarantees to passenger airlines, according to Forbes. Cargo airlines like FedEx would get $4 billion in grants and up to $4 billion in loans, and airline industry contractors could get $3 billion in grants. It was not immediately clear if these details remained in the final bill.

The bill says grants are exclusively to pay employee wages, salaries and benefits based on how much the airline spent on them from April through September of last year. Loans would carry conditions, including bans on companies buying back their own stock or paying dividends. Airlines would have to avoid layoffs “to the extent practicable,” and would be required to keep at least 90% of current employment levels.

Health care

The industry will get $150 billion. That includes $100 billion for grants to hospitals, public and nonprofit health organizations and Medicare and Medicaid suppliers.

Department of Homeland Security

$45 billion for a disaster relief fund to reimburse state and local governments for medical response, community services and other safety measures. Extends federal deadline for people getting driver's licenses with enhanced security features, called REAL ID, from Oct. 1, 2020, to Sept. 30, 2021.

Education

$31 billion. Includes $13.5 billion for states to distribute to local schools and programs, $14 billion to help universities and colleges.

Coronavirus treatments

$27 billion for research and development of vaccines and treatments, stockpiling medical supplies.

Transportation

Includes $25 billion for public transit systems; $10 billion for publicly owned commercial airports, intended to sustain 430,000 transit jobs; $1 billion for Amtrak.

Veterans

$20 billion, including $16 billion for treating veterans at VA facilities; $3 billion for temporary and mobile facilities.

Food and agriculture

$15.5 billion for food stamps; $14 billion for supporting farm income and crop prices; $9.5 billion for specific producers including specialty crops, dairy and livestock; $8.8 billion child nutrition. Money for food banks, farmers' markets.

Defense

$10.5 billion for Defense Department, including $1.5 billion to nearly triple the 4,300 beds currently in military hospitals; $1.4 billion for states to deploy up to 20,000 members of National Guard for six months; $1 billion under Defense Production Act to help private industry boost production of medical gear. Money cannot be used to build Trump's proposed wall along the Mexican border.

Social programs

Includes $3.5 billion in grants for child care and early education programs; $1 billion in grants to help communities address local economic problems; $900 million in heating, cooling aid for low-income families; $750 million for extra staffing for Head Start programs.

Economic aid to communities

$5 billion in Community Development Block Grants to help state and local governments expand health facilities, child care centers, food banks and senior services; $4 billion in assistance for homeless people; $3 billion for low-income renters; $1.5 billion to help communities rebuild local industries including tourism, industry supply chains, business loans; $300 million for fishing industry.

Native American communities

$2 billion for health care, equipment schools and other needs.

Diplomacy

$1.1 billion, including $324 million to evacuate Americans and diplomats overseas; $350 million to help refugees; $258 million in international disaster aid; $88 million for the Peace Corps to evacuate its volunteers abroad.

Elections

$400 million to help states prepare for 2020 elections with steps including expanded vote by mail, additional polling locations.

Arts

$150 million for federal grants to state and local arts and humanities programs; $75 million for Corporation for Public Broadcasting; $25 million for Washington, D.C., Kennedy Center for the Performing Arts.

Congress

$93 million, including $25 million for the House and $10 million for the smaller Senate for teleworking and other costs; $25 million for cleaning the Capitol and congressional office buildings.