TUMWATER, Wash. — Washington consumers looking to cut their health care costs in the face of rising premiums are being warned to steer clear of religious-based plans that look like insurance, but don’t operate by the same rules.

“Don’t fall for it. They’re not going to help you,” said an angry Bethany Stull, who believed that her coverage through a company called OneShare would cover her medications for treatment of a brain tumor. “Every single time I got a big invoice (from the doctor) and it said patient’s responsibility and it was 100% of the bill.”

That was when she learned that OneShare is not legally an insurance company. It’s listed as a “Health Care Sharing Ministry,” which has certain protections under federal law.

One of them is that, unlike a regulated insurance company, it does not have to pay claims for legitimate medical expenses.

“This is not OK. I want my money back,” said Stull.

Records obtained by the KING 5 Investigators show that 194 consumer complaints have been filed against healthcare sharing ministries (HCSMs) since 2020. Forty-four are against Irving, Texas-based OneShare, mostly for not paying customers medical bills.

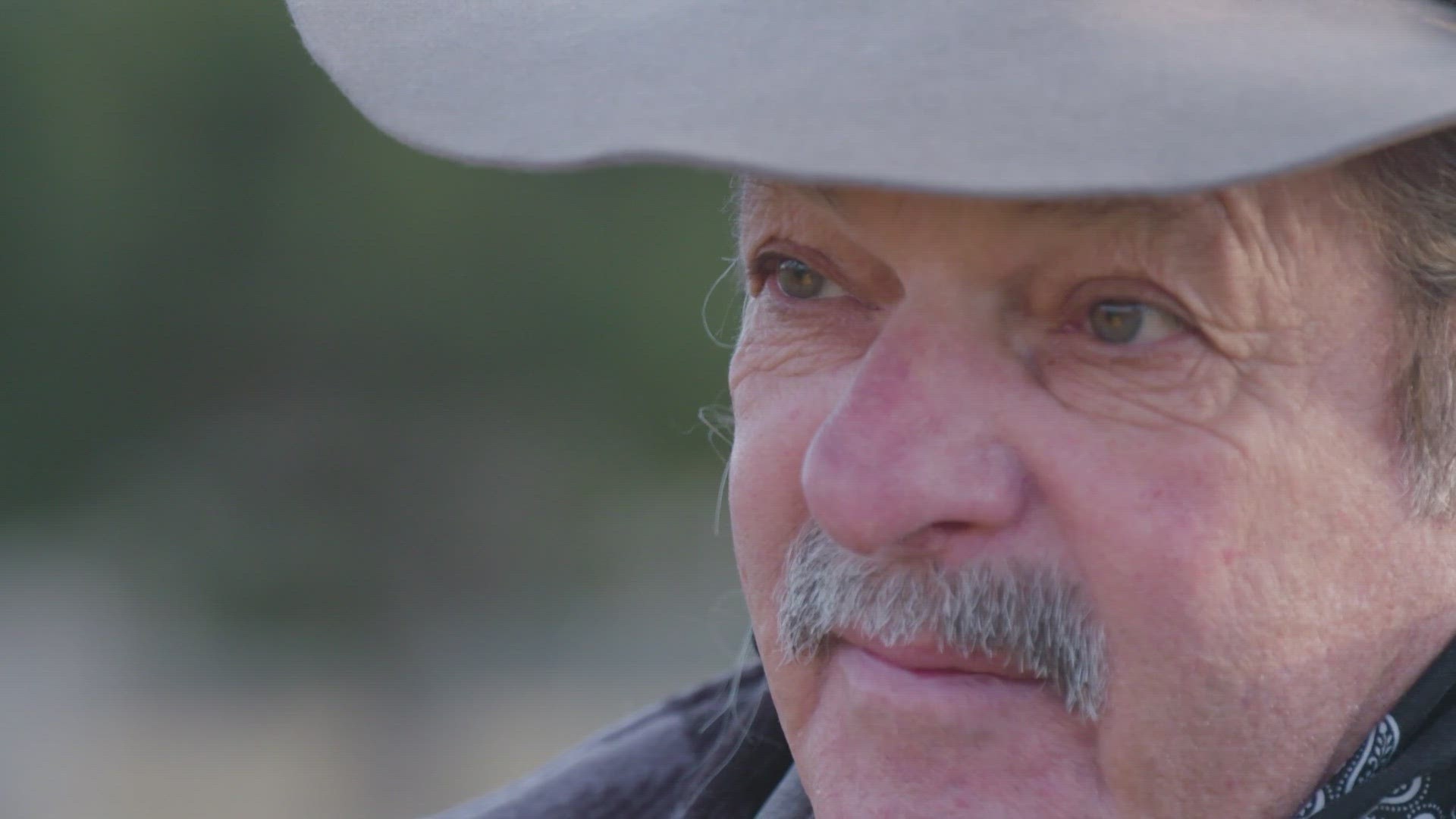

Dea Dunfee of Selah received coverage through the trucking company he worked for and didn’t realize what it was until $40,000 in hospital bills from a stroke went unpaid.

He called a OneShare rep and was told, “If you read your policy further you will find out that we’re not an insurance company, that we are a Christian service.”

“We will pray for your health,” Dunfee said the rep told him. “I had no way to pay $40,000 and prayer wasn’t going to get it for me,” said Dunfee.

What’s worse, consumers who believe they are being cheated have no place to turn.

The Office of the Insurance Commissioner (OIC) for Washington State says it has no authority to recoup losses from health-sharing ministries that don’t cover consumer’s bills.

“They want us to go after the health care sharing ministry, for them to pay their claim. That’s out of our purview, “ said OIC Deputy Commissioner Michael Marchand.

When Congress approved the Affordable Care Act in 2010, Republicans and religious organizations pushed for a carve-out that allowed HCSMs to operate under broad exemptions from the Act.

For instance, HCSMs do not have to guarantee payment of legitimate claims, cover essential benefits like mental health treatment or pre-existing conditions, or cap out-of-pocket expenses. They can’t call themselves “insurance” companies, but they can look and act like them – without following any insurance regulations.

“That’s like a ‘Get Out of Jail Free' card that gives them just carte blanche to not pay anything,” Marchand said.

An attorney for OneShare said, “Each member is required to attest to our Statement of Beliefs, which is founded on and cites Biblical principles.” Attorney Buddy Combs continued, “Each member must sign a member agreement which lays out clearly the nature of the organization and the expectations for both the member and the ministry.”

The Alliance of Health Care Sharing Ministries, an industry organization, would not provide a statement to KING 5.

Consumers may be drawn to HCSMs because of a lower monthly cost. They also advertise the “Christian community” and “cost-sharing” benefits of their plans. Customers who don’t want their insurance companies funding abortions or other controversial measures prefer HCSMs.

After complaints piled up against OneShare, the OIC investigated and in 2021 fined the company $150,000 for “selling insurance illegally.” In a settlement, OneShare agreed to stop enrolling new customers in Washington State.

OneShare called the allegations in that case “legally and factually incorrect” but said it settled “to avoid protracted and costly litigation.”

OIC gave KING 5 a list of the HCSMs it has taken action against to date.

- Aliera/Trinity (case no. 1589861)

- OneShare (case no. 1602460)

- Makina Health (case no. 1602564)

- Alliance for Shared Health (case no. 1602799)

- Liberty Healthshare (case no. 1615698)

- Zion Health (case no. 1621417)

- Christian Care Ministries—only their Manna-Care product (case no. 1651434)

- Unite Health Share Ministries, Inc. (case no. 1683896)

But that kind of enforcement is rare and happens only when an HCSM deceptively markets its product as “insurance.”

The OIC says, even with the agreement in place, it cannot require OneShare to reimburse customers like Stull and Dunfee, who paid tens of thousands of dollars in the belief that they had insurance coverage.

“I would caution against anyone signing up for a health care sharing ministry. It's just a much higher risk with a lot less reward at the end of the day,” said Marchand, the Deputy Insurance Commissioner.

The OIC recommends consumers check with its office before signing with an HCSM. The Office of the Insurance Commissioner can be reached at 800-562-6900 or through its website. Find more information about how to get help with an insurance problem or question here.