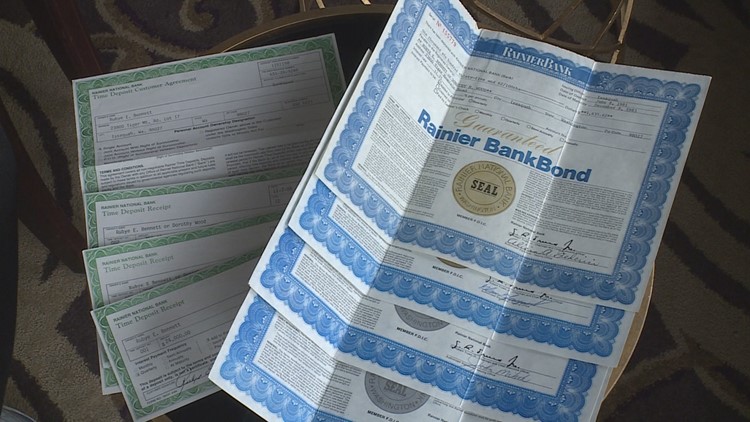

Washington-based Rainier Bank dissolved after merging with other banking corporations. Decades later, some former customers are trying to redeem their Rainier Bank bills.

A group of former Rainier Bank customers who said they tried to cash in their decades-old family investments and were told there was no record of the money, just settled with Bank of America.

The customers alleged the bank, after a series of acquisitions, was responsible for their bank bills, which were originally issued by the now-defunct Rainier Bank.

When customers tried to redeem their money, they said Bank of America told them it had no record of the bills.

The terms of the settlement are confidential, and it’s unclear how much they walked away with. The customers were, in some cases, seeking hundreds of thousands of dollars.

In a statement, Bank of America said it's “working to reach an amicable resolution with for the parties.”

“It has been frustrating, a lot of running around, a lot of back and forth,” said William Bossen, who is still waiting for his money, which he thinks is the responsibility of Key Bank.

Bossen said he received the bank bills from his grandfather as a gift in 1980 when he was five years old. Decades later, Bossen is counting on the investments to help him buy a home in Seattle. He thinks they’re worth about $150,000 today.

Bossen and his attorney Eric Harrison said Key Bank, which also acquired the assets of some former Rainier Banks, is digging in its heels and refusing to pay, so they are suing Key Bank.

“It's very irritating, and as much as I love my lawyer, I don't want to have to pay him parts of money that is owed to me just to make sure that the bank fulfills its obligations,” Bossen said.

Key Bank told KING 5 it doesn’t comment on legal matters.

Bossen said he thinks there are hundreds, maybe thousands, of Rainier Bank bills in peoples' safe deposit boxes and file cabinets, their owners unaware of just how challenging it'll be to claim their cash.

Bank of America says customers who have questions or concerns should contact the bank's customer service department.