SEATTLE — More people could be getting a break on their property taxes in 2020 thanks to increased income thresholds for relief programs.

The change stems from a law going into effect Sunday, July 28.

ESSB 5160 modified the income thresholds for property tax exemptions or deferrals from a flat value to a percentage of the county’s median household income. Low-income seniors, people with disabilities, and disabled veterans that make less than 65% of the median income will soon be eligible for an exemption; previously the income threshold was $40,000 across the state. The deferral program threshold is now 75% of the median income compared to a $45,000 threshold.

The disability rating for required for disabled veterans to qualify for relief was also reduced from 100% to 80%.

“This legislation is literally going to help people stay in their homes,” King County Assessor John Wilson said in a statement.

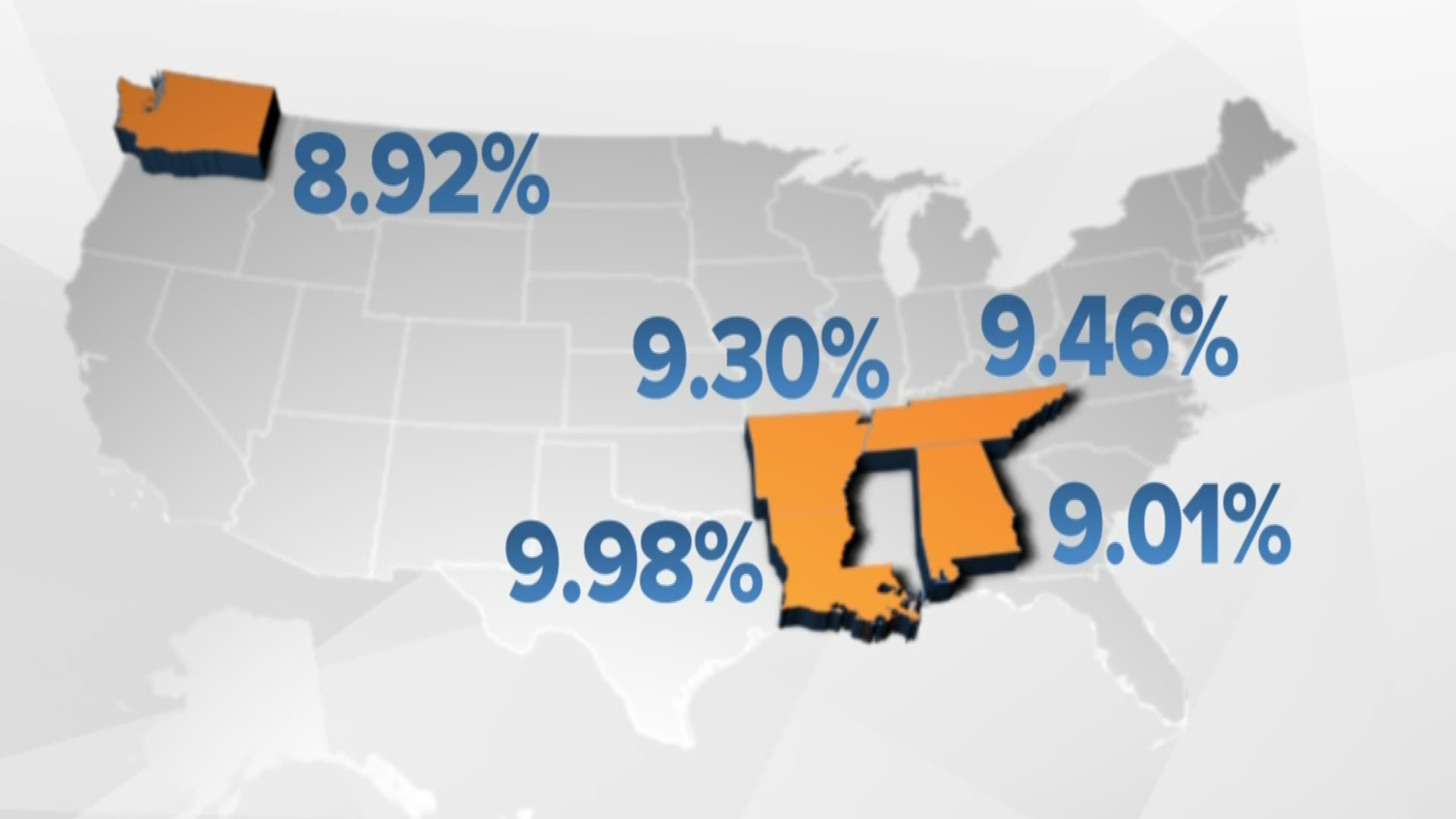

Thirteen counties across Washington, including King, Snohomish, Pierce, and Kitsap, will see income thresholds increase, according to figures from the Department of Revenue. The rest will remain at $40,000.

In King County, eligible residents can qualify for a property tax exemption if they make less than $58,423 per year, which is the highest threshold in the state. The Snohomish County exemption threshold increased to $55,749, and Pierce County increased to $45,708.

These thresholds will hold until 2024, and then the Department of Revenue will recalculate based on current median income.

Thousands of people have taken advantage of the tax relief programs, and officials expect that number to rise as more people become eligible. In 2016, 34,974 seniors and disabled people in King, Pierce, and Snohomish counties qualified for a tax exemption, according to the Department of Revenue. Another 317 people qualified for a deferral.

People can apply for the program beginning in January 2020. The new thresholds will be in effect for 2020 property taxes.