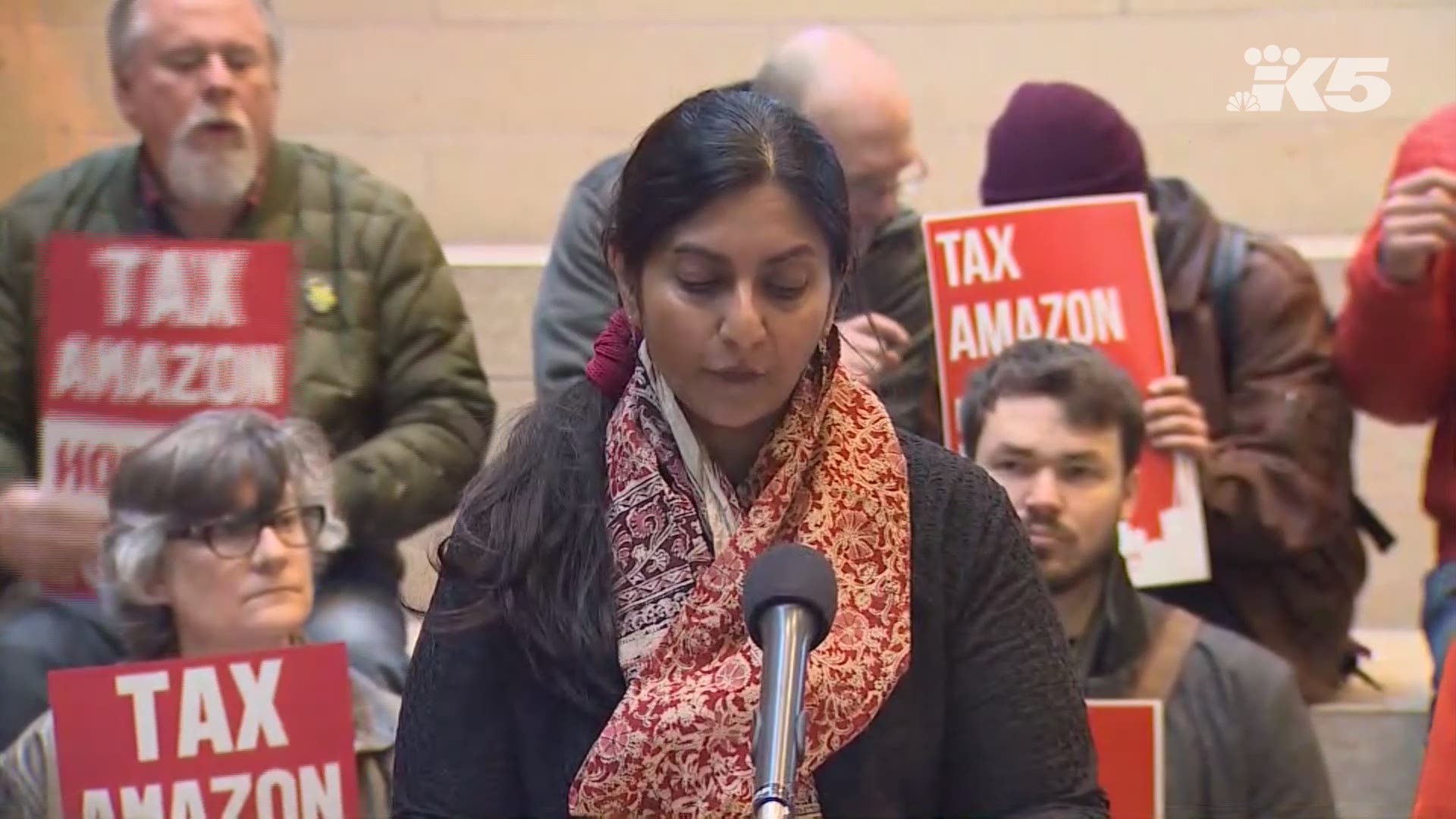

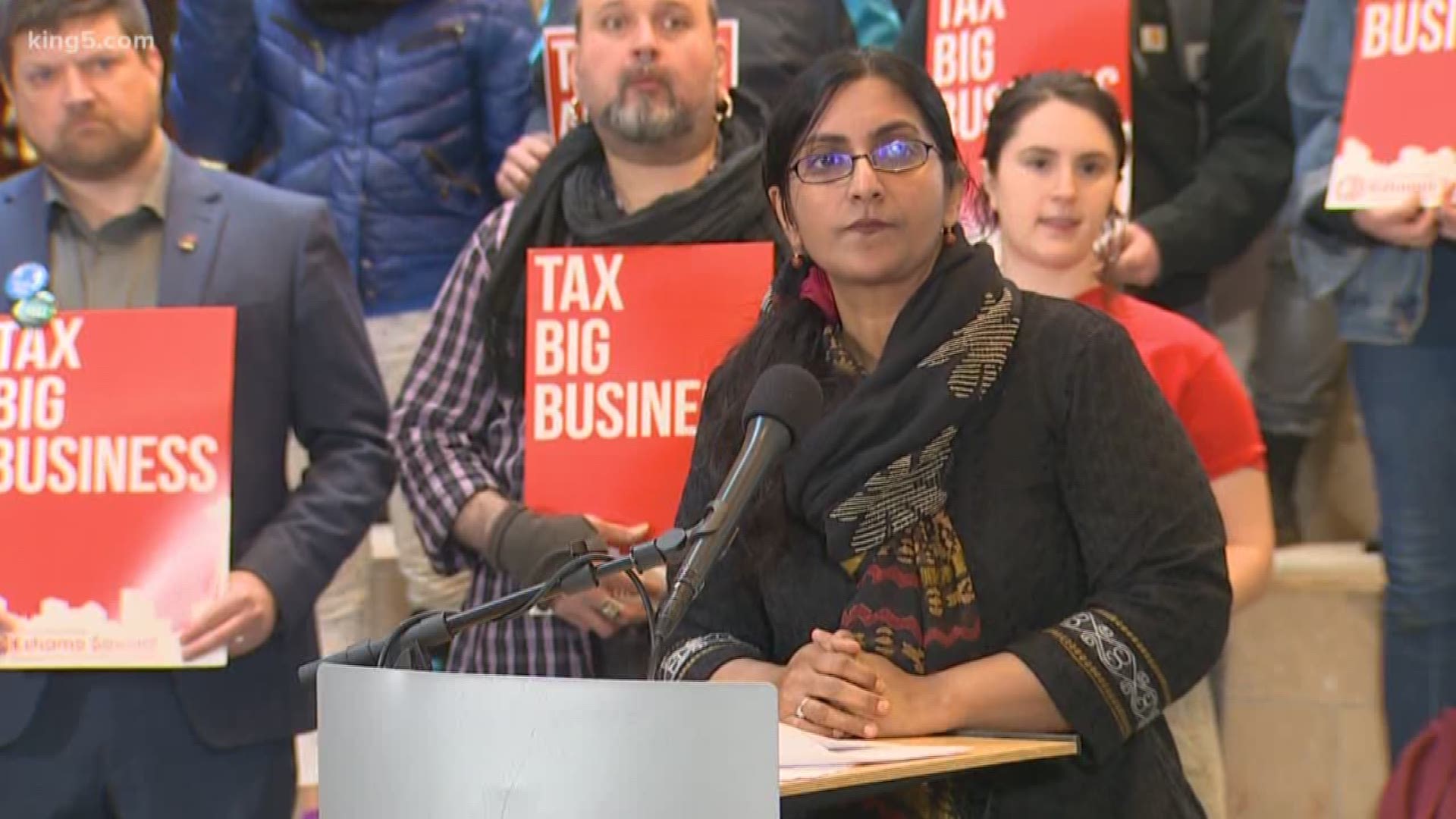

SEATTLE — Seattle City Councilmember Kshama Sawant unveiled draft legislation to tax Amazon and other big businesses in Seattle Wednesday morning.

Sawant said the legislation, which is co-sponsored by Councilmember Tammy Morales, would bring in $300 million in revenue a year using a 0.7 percent payroll tax. The additional revenue would be used to build affordable public housing in Seattle.

The payroll tax would impact the top 3 percent of the city’s biggest companies, measured by payroll size. Around 800 of Seattle’s nearly 23,000 companies would have to pay the tax.

“No small businesses or medium businesses will be impacted,” Sawant said during a press conference. “Furthermore, no nonprofit organizations or cooperatives will be paying this tax. Grocery stores will also be exempted, and government and educational employers will also be exempted.”

The legislation would help build 8,000 new affordable, publicly owned homes over the next 10 years, and retrofit 47,000 others to meet the city’s climate needs.

Sawant said 75 percent of the revenue would be dedicated to social housing and other related services. The other 25 percent of the revenue, which is about $75 million per year, would be dedicated toward Green New Deal investments in existing homes, such as “weatherization, solar installations, transitioning homes from oil and gas to electric, and investing in job training programs to ensure a just transition to support workers in a renewable energy economy,” Sawant said.