Seattle Mayor Ed Murray is expected to sign the city’s new income tax on high earners into law next week.

The mayor was scheduled to sign the ordinance on Friday, but his news conference was postponed without explanation on Thursday.

Meanwhile, the Olympia-based Freedom Foundation is already talking about a potential legal challenge. A spokesman says the group is looking to lead a coalition of partners; a challenge could come as early as the next couple of weeks.

“The Seattle City Council bought itself a lawsuit,” said former State Supreme Court Justice Phil Talmadge.

Talmadge knows the debate well; it’s one that dates back nearly a century in Washington state.

“Back in the 1930s, the people adopted a straight forward, graduated net income tax by initiative, and the court said ‘No; income is property.”

The crux of the age old issue revolves around the state Constitution’s uniformity clause and a vague definition of property that the court decided should include income.

“Those decisions were very clear cut and basically the court reaffirmed that position in the late 1990s, 2000 period,” said Talmadge, who sat on the Supreme Court when the issue was most recently revisited in a case involving Mukilteo.

“In fact, I dissented in that case; I thought those older cases that should no longer be viable. Whether the present Supreme Court agrees or disagrees with that, we'll wait and see when they issue their opinion.”

Supporters of Seattle's new tax on high earners passed Monday believe the case could potentially set a new legal precedent if it winds up making it to Washington's high court.

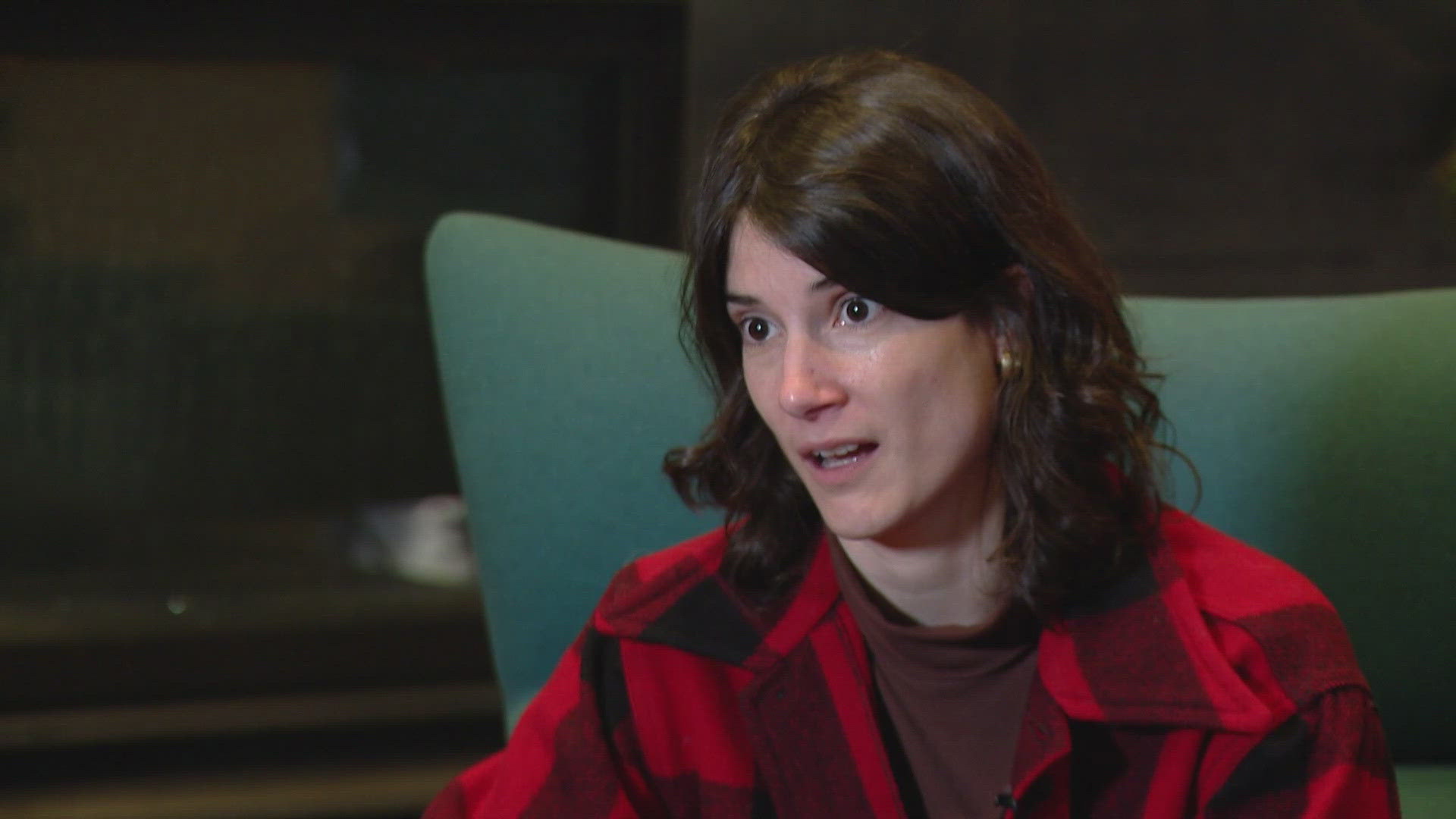

"I'm really confident that today's Supreme Court is going to undertake the rigorous analysis that's been missing and leading to again a very regressive but also unreasoned tax structure in this state," said attorney Claire Tonry, who has been working with the coalition that crafted the city's ordinance.

Tonry points to other state courts that have reinterpreted their own uniformity clauses and overturned earlier decisions. She cites one such case out of Iowa that made it all the way up to the U.S. Supreme Court: Hale v. State Board of Assessment & Review.

“The vast majority of states with uniformity clauses in their Constitution permit a progressive income tax.”

If and when Washington's Supreme Court receives the Seattle case, the current justices will have to decide whether the state's past legal precedent should continue to apply or whether it should no longer stand, according to Talmadge.

“Whether that principle is somehow now actually harmful and contrary to law and therefore something that it should abandon,” he continued.

Talmadge believes the court case could take two to three years; supporters of the ordinance believe it will take less time than that if expedited.