OLYMPIA, Wash. — Gov. Jay Inslee has unveiled his proposed budget for the 2021-23 budget cycle for Washington state, which includes a capital gains tax and a tax on health insurers.

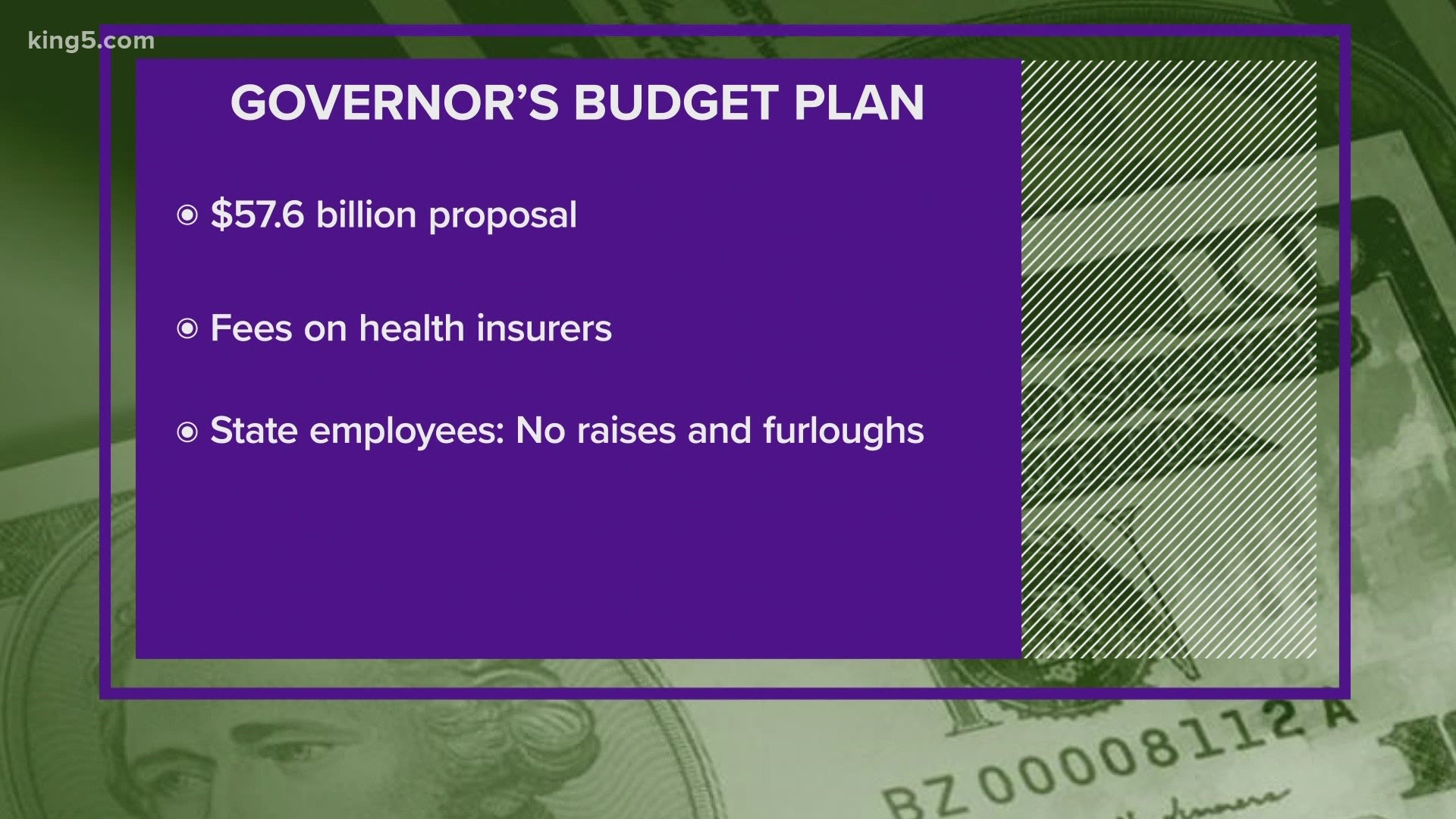

Inslee's proposed $57.56 billion budget is just the first of three to be released in the coming months. After the legislative session begins in January, the Senate and House will also release proposals during the 105-day session, which will be held mostly remotely.

It's no secret that the coronavirus pandemic has drastically impacted the state's budget. According to Inslee's office, as of November, the state had about 217,000 fewer jobs than in February, and revenue projections for the next three years remained more than $3.3 billion below pre-pandemic levels.

Inslee's latest budget proposal includes $397 million ($447 million total funds) to support the state's ongoing response to the pandemic. This includes funding for PPE, testing supplies, lab costs, staff for contact tracing, the state public health lab and epidemiology work. The funds will also go towards the Department of Health to assist with vaccine distribution.

Inslee says he plans to urge the Legislature in January to pass legislation approving an additional $100 million in grants to help businesses and an additional $100 million in rental assistance for tenants and landlords.

The governor's budget also includes funds to help the state's unemployment system, which has been strained by the staggering job losses since the start of the pandemic.

"We must invest in the relief, recovery and resilience of Washington. We cannot cut the things that we need most during a pandemic," Inslee said during a press conference Thursday. "In my proposed operating, capital and transportation budgets, I am investing in the people of our state."

Inslee is also proposing a new capital gains tax, which would affect a small fraction of the state's wealthiest taxpayers. The proposed tax change, which would not go into effect until the second year of the 2021-23 biennium, would raise more than $3.5 billion over the next four years. The proposed capital gains tax would not apply to sole proprietor businesses, retirement accounts, homes, farms and forestry. Earned income from salaries and wages are not capital gains and would not be taxed.

In addition, to help fund ongoing public health needs as a result of the pandemic, Inslee is proposing a new per member/per month assessment on health insurance carriers. Inslee says it will raise an estimated $205 million during the second year of the next biennium, then about $343 million in the 2023-25 biennium.

Inslee is also forgoing giving most state employees wage increases to help combat the budget shortfalls created by the pandemic. Under his proposal, most state employees won't get a wage increase for two years. Most state employees will also take 24 unpaid furlough days over the next two years, equating to a 4.6% pay reduction for most employees, according to Inslee's office.

Homelessness continues to be a problem in Washington state, which has only been made worse by the pandemic. Inslee's proposal includes nearly $400 million to build more affordable housing units and preserve the state's existing housing stock. The budget will also send $150 million to the state's Public Works Assistance Program, which provides low-or no-interest loans that local governments can use for repairing everything from bridges and roads to water and sewer systems.

The governor's budget also includes funding to help students impacted by the pandemic get back on track, including providing broadband connections for families who cannot afford internet services. His budget also continues funding to support child care businesses and help low-income families afford child care.

Besides the pandemic, 2020 has also been a year that has seen intense racial reckoning across the country. Inslee's budget includes funding for an "equity office" as a tool to root out racism and discrimination. It also includes funds to establish an office that investigates police using excessive force, eliminate contracting disparities, and introduce an equitable financial literacy plan to help communities of color.

Also as a result of COVID-19's impact on communities and households, Inslee is proposing tapping future bond capacity now to help stimulate the economy and retain construction jobs.

Under the governor's proposal, the state's total bond capacity would increase by $1.25 billion to nearly $4.7 billion for the 2021-23 capital budget. Including other state and federal fund sources, Inslee's capital budget for the next two years totals nearly $6.2 billion.

The governor's budget also includes funding to support transportation projects, preserving habitat for migrating salmon and steelhead, and reducing greenhouse gas emissions by investing in clean transportation.

The capital budget also includes:

- Over $800 million for 80 school projects statewide.

- $45 million to expand broadband access for underserved homes and businesses.

- $39 million to construct the new Nisqually State Park and fund major improvement projects at three other parks.

- $51 million to fund design work and site demolition for a new 350-bed forensic psychiatric hospital on the Western State Hospital campus.

- Nearly $120 million to design and construct a new 120-bed nursing facility to care for clients with intellectual and physical disabilities.

- Nearly $27 million to improve the health of 58,000 acres of Washington forests to reduce wildfire risk and severity and de develop healthy, resilient forests for the future.