OLYMPIA, Wash. — Is it a sneaky way to establish a state income tax, or a maneuver to make the state’s tax system more fair? As with most topics at the state Capitol in Olympia, it depends who you ask.

The latest public hearing on a move to establish a capital gains tax prompted more than 3,900 people to sign into the state’s legislative website. The majority of those who signed up support the move to tax investors who make more than $250,000 in the sale of stocks or bonds in a single year.

Bill sponsors said the money raised would go towards early education and finding ways to make the state’s tax system more equitable. The bill passed out of the state Senate earlier this month.

“In Washington, more so than any other state, the higher your income, the lower your tax rate,” Dylan Gundham O’Neill told lawmakers.

Sakara Remmu, from the Washington Black Lives Matter Alliance, said this issue was her organization’s top priority for the legislature.

"Not police accountability, a capital gains tax,” said Remmu. “This is about the whole of Black life and the resources that have been stripped from our community, that have never made it to our community in many cases.”

Opponents included Freedom Foundation Director of Labor Policy, Maxford Nelson. “We believe this capital gains tax is unnecessary, punitive, and unconstitutional,” said Nelson.

He said the tax on investment earnings should be considered a tax on income, something that is unconstitutional in the state.

Backers of the bill said a tax on capital gains would be considered an excise tax.

U.S. Representative Dan Newhouse, D-Washington, also testified against the measure Monday.

“If this legislation were signed into law and the off-chance it's certified by the courts it would open the door to an income tax on all Washingtonians and take away one of our best competitive advantages to attract new business,” said Newhouse.

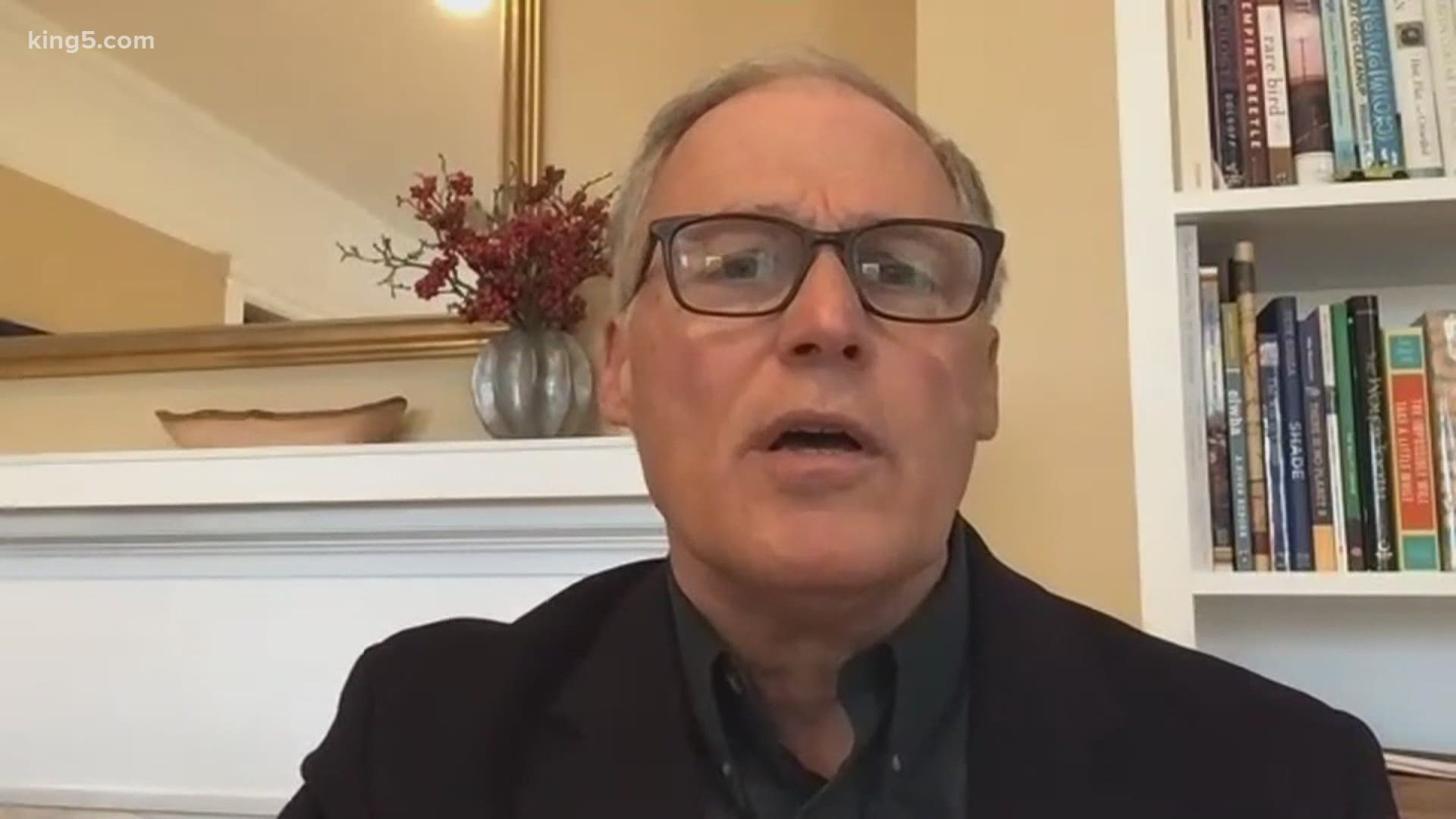

Gov. Jay Inslee, D-Washington, has repeatedly proposed establishing a capital gains tax in the state.